Investing for the future is something that the majority of us, if not all of us, are taking into consideration, quite seriously, especially with the global financial crisis that we are experiencing. We want to save and invest for our future. Perhaps one of the best investments today is opening a health savings account.

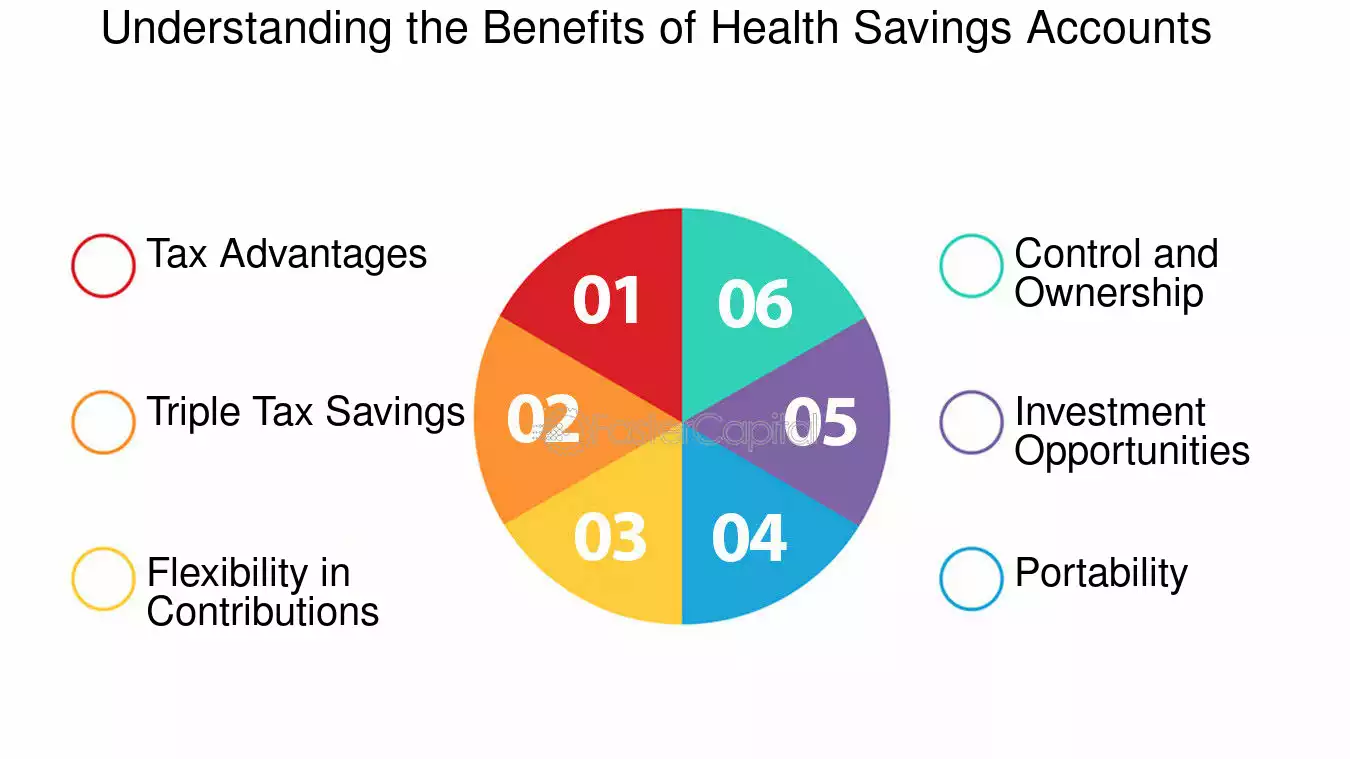

One of the primary reasons why health savings account are considered to be a good investment, is that you will have full control of where to invest your money. You can decide to invest your money in stocks, mutual funds, bonds, or any investment channel, you think your money will earn more, with the bank of your choice acting as your health savings account administrator.

Health savings account are often regarded as a second retirement investment. One of the attractions about this type of account, as an investment, is that the funds that you put into it are permitted to grow minus the taxes that are often associated with other investment schemes. This little trick will help you to earn a better return with on your money.

Another benefit that you can get from investing in your health savings account, is that you can use the funds to pay for your medical expenses. You can also pay your health care premiums using your health savings account. There are health expenses that your health care insurance, like Medicare, will not be able to cover for you, but your health savings account will assume.

This an important facet, of the health savings account, now that the cost for health care is soaring rapidly. This account is your best tool to build up your funds necessary to shoulder the rising cost of health care; once you retire from your full time employment. This is the only account where you can withdraw money practically tax-free to shell out for your medical costs.

The amount that you can earn from your health savings account is dependent on the following factors:

1. Amount of your annual contributions.

2. Length of time that you have contributed.

3. Your investment return.

4. Length of time before you withdraw funds from your account.

You can always get the most out of your health savings account as follows: (1) you can take the risk and invest the funds into high yielding investment vehicles such as the stock market, and the likes; (2) do not make any withdrawals from your health savings account for as long as possible; (3) deposit the maximum amount of money you can make at the start of each year.

In a capsule, to increase your ROI on your health savings account is to fund it annually, preferably at the start of the year, put the money to work wisely and delay any withdrawals.